According to several accounts, the CEO of a Turkish crypto exchange allegedly fled with up to $2 billion in user cash. An investigation has been opened by the authorities.

A Turkish bitcoin exchange has over 400,000 customers who were unable to access their accounts or withdraw money. The platform’s website has been down for a few days, and according to sources, its CEO may have already left the country with up to $2 billion.

Does a Rug Pull in a Turkish Exchange?

Thodex, a cryptocurrency exchange with operations in Turkey, reportedly stopped trading Wednesday, claiming a “unspecified partnership deal,” according to Bloomberg. The trading platform, which was established in 2017, announced in a statement that all services will be suspended for about five working days. Customers were told, however, that they need not be concerned about their finances by the message.

However, about the same time, customers began to gripe about not being able to access their own assets. Some used Twitter to illustrate how ridiculous the scenario was.

Users Claim to Be Fraudulent

Users of the neighborhood exchange engaged a law firm to submit a lawsuit against Thodex after hearing about Ozer’s suspected flight from Turkey. Thodex customer representative Oguz Evren Kilic acknowledged the development and stated, “We have filed a court complaint on Wednesday.”

Considering that there are just around 400,000 users, he estimated that the funds on the Turkish exchange may be worth “hundreds of millions of dollars.” An inquiry has apparently been opened by an Istanbul prosecutor.

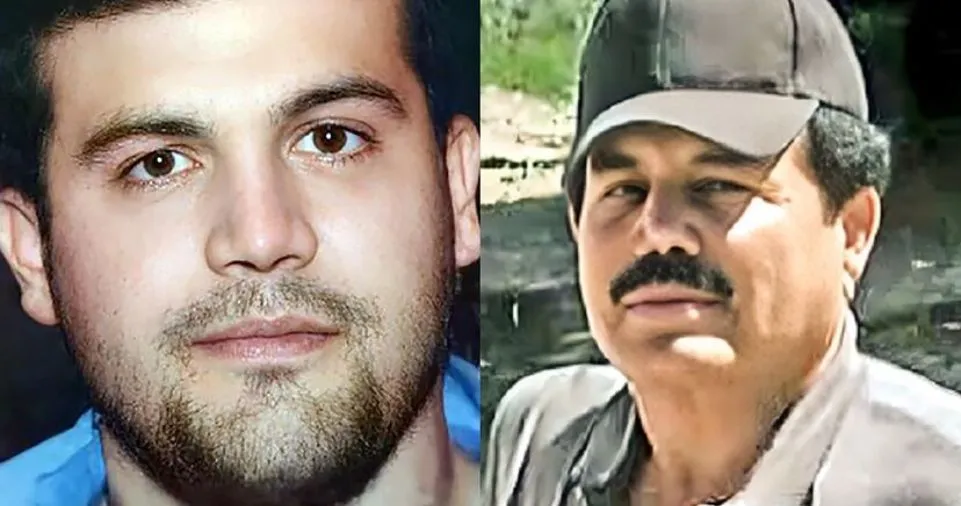

Another allegation claims that the CEO and founder of Thodex fled to Thailand with an estimated $2 billion.

It’s important to note that Turkish officials have already adopted a harsh stance on the bitcoin sector.

Turkish authorities are requesting severe prison terms for the Thodex founders.

Turkish prosecutors are requesting prison terms reaching thousands of years for Thodex’s founders and other senior team members since they are accused of suspending trading as part of an exit scam.

Authorities claim they participated in a fraud and money-laundering conspiracy that resulted in losses of more than 350 million Turkish liras, or over $20 million at the time of writing.

Cyberasset fraud

The Thodex exchange engaged in intensive marketing campaigns to draw in investors. It first committed to distributing high-end automobiles with a flashy advertising campaign that highlighted well-known Turkish beauty.

The exchange did, however, stop trading in April of last year after posting a mysterious statement a few days earlier indicating that it would require five days to address an undisclosed outside investment.

The Istanbul-based Thodex went offline after a promotional campaign that saw Dogecoins sold at a sixth of what they were selling for on other exchanges. The exchange, however, restricted access to such investments and outlawed the selling of coins or their exchange for other cryptocurrencies. More than 60 persons were taken into custody from the digital exchange with a basis in Turkey.

Stricter cryptocurrency rules in effect

As the Turkish cryptocurrency market started to tank, the hunt for Ozer got under way. President Recep Tayyip Erdogan’s administration warned of the risks and outlined steps to control the digital currency sector.

The Regulation on the Disuse of Crypto Assets in Payments was made public by the Turkish Central Bank and appeared in the official government journal. Many Turks had discovered that, despite a dramatic decrease in the value of the lira, employing digital assets had allowed them to keep their savings.

Several nations, including those of India, China, and Russia, have said they would impose stronger laws in response to concerns about the potential for cryptocurrencies to be used in crime and their erratic trading.

Many central banks throughout the world have implemented easy-money policies over the years, which has immensely benefitted the cryptocurrency sector. However, persistent inflation has forced governments throughout the world to adopt stricter monetary policies, which hastened the industry’s demise.