In the past few years, Cftc bitmex 10m kyckeely theblock have expanded rapidly, providing unheard-of access to digital assets and financial services. For governments and regulatory bodies, the absence of control and regulation of the market has produced a difficult climate. As a consequence, The Block, BitMEX 10M KYC/Keely, and the Commodity Futures Trading Commission (CFTC) have all sought to provide openness and clarity to the cryptocurrency market. The impact of these three significant participants on the worldwide landscape of bitcoin regulation will be examined in this essay.

Describe Bitmex.

One of the oldest and most well-known cryptocurrency exchanges in the world is Bitmex. Users may trade a number of digital currencies, including Bitcoin Cash, Ethereum, Litecoin, and Bitcoin.

Bitmex provides a user-friendly interface with several features, including a live market and order book, in addition to margin trading and lending.

In general, Bitmex is a trustworthy and easy-to-use exchange that lets you trade different digital currencies.

How to register with Bitmex

Users of the cryptocurrency exchange Bitmex may trade Bitcoin, Ethereum, Litecoin, and other cryptocurrencies on this platform. You need to provide your name, email address, and phone number in order to join up for Bitmex. After enrolling, you must authenticate your account by uploading a copy of an ID card or driver’s license that has been granted by the government. Finally, you must come up with a password for your account.

You may start trading on Bitmex by clicking the “Exchange” button at the top of the screen and choosing the currency pairings you wish to switch between after creating an account and verifying it. On the “Charts” page, you can also see historical prices and charts. Use a wallet that supports cryptocurrency trading while trading on Bitmex to maintain custody of your coins.

Tips for using Bitmex

Users of the cryptocurrency exchange Bitmex may trade major digital assets including Bitcoin, Ethereum, and others. Bitmex, which was established in 2014, is one of the biggest and most well-known companies.

Create an account first before using Bitmex. You must provide the bare minimum of data when creating your account, including your email address and username. Create an API key after that, and then add it to your account settings. You may use this key to access the platform’s more sophisticated features, like stop orders and margin trading.

You need to deposit money before you can trade on Bitmex. You may fund your account with Bitcoin or Ethereum, then sell those assets by utilizing the associated trading pairings. Visit the Trading Pairs page to see all of Bitmex’s trading pairs.

Prior to making any deals while trading on Bitmex, make sure to properly analyze your risk exposure. Before making any financial commitments, make sure you are completely aware of the dangers involved with any asset you are trading. Additionally, bear in mind that market circumstances may change suddenly, so keep a careful eye on the status of your holdings at all times.

What characteristics does Bitmex have?

A cryptocurrency exchange called Bitmex focuses on trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and other alternative cryptocurrencies. The platform is easy to use and has both high liquidity and minimal costs.

Additionally, Bitmex provides margin trading, which enables users to enhance their cryptocurrency investment by borrowing money from the exchange. Trading on higher positions is made possible without putting funds at risk. Additionally, Bitmex offers a bot that lets users trade automatically using pre-programmed parameters.

The Bitmex website is simple to use and enables new users to get going right away. An thorough user manual is available on the website and covers everything from account creation to margin trading.

Methods for trading on Bitmex

Users of the cryptocurrency exchange Bitmex may trade a variety of alternative currencies and tokens. You must register for an account and provide personal data in order to use Bitmex. After registering, you may start trading by choosing the currencies and tokens you wish to use.

The trading options available on Bitmex include loan, short selling, and margin trading. Users that utilize margin trading may borrow money from the exchange to boost their potential earnings. Users may sell assets they do not own in order to short assets in order to benefit from a price fall. Users who engage in lending may borrow cryptocurrency to spend on the exchange to make other transactions.

Additionally, Bitmex provides a vast array of security measures, such as two-factor authentication and real-time trade reversal. Additionally, the platform provides live support around-the-clock, making it simple for customers to get help if they run into any difficulties when trading on Bitmex.

Which dangers come with trading on Bitmex?

Users may trade cryptocurrencies like Bitcoin, Ethereum, Litecoin, and other digital assets on Bitmex. The platform’s lax security procedures and lack of transparency have drawn criticism.

According to preliminary study, trading on Bitmex carries some risk. These dangers consist of:

- Lack of transparency: Bitmex needs to make it simpler for consumers to comprehend the platform’s inner workings. It makes determining the risk/reward profile of any transaction difficult.

- Unable to verify deposits and withdrawals: Before making a deposit or withdrawal, users on Bitmex are not required to provide identification or evidence of their financial soundness. It exposes users to theft and fraud.

- Inadequate security: Bitmex is often subjected to DAO attacks (where hackers exploit weaknesses in intelligent contracts to steal tokens). On the site, there have been a number of hacking attempts in recent months.

- High volatility: On Bitmex, the cost of bitcoin and other digital assets swings significantly every day. As a consequence, traders need assistance in generating steady gains over time.

The CFTC

The US government organization in charge of policing the futures and options markets is called the Commodity Futures Trading Commission (CFTC). Additionally, it is in charge of overseeing the exchanges for commodities and derivatives, including those for cryptocurrency. The CFTC has adopted a proactive approach to the creation of rules and recommendations for the cryptocurrency industry. The CFTC requested public feedback on digital assets, the underlying technology, and the prospect for further regulation of the cryptocurrency markets in July 2019.

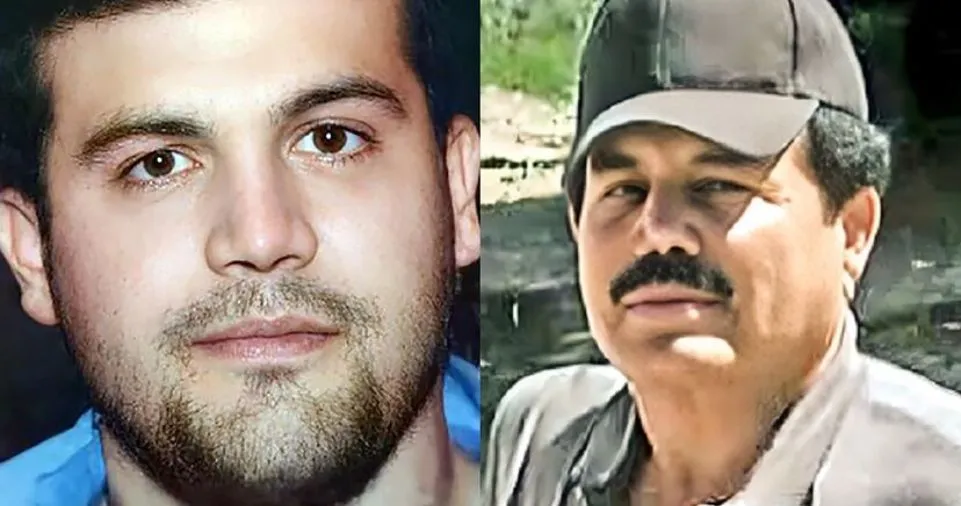

In addition, the CFTC is in charge of prosecuting companies that break the law. The CFTC accused BitMEX of failing to register as a derivative trading platform and providing illicit transactions in October 2019. The CFTC further claimed that BitMEX had broken relevant rules and had not followed proper anti-money laundering (AML) and know your customer (KYC) procedures.

A number of advisory materials on the regulation of cryptocurrencies have also been released by the CFTC. These have included recommendations for using virtual currencies for margin trading and for disclosing virtual currency transactions.

10M KYC/Keely BitMEX

The exchange started a $10 million KYC/Keely initiative in November 2019 in response to the Cftc BitMEX 10m kyckeely theblock enforcement action. Users will be able to save and monitor their client data as well as adhere to KYC and AML regulations thanks to the program’s features. The initiative offers customers a safe platform to keep their client data and was developed in response to the CFTC’s need for more openness.

Users may submit their personal data to the KYC/Keely program, including their complete name, address, date of birth, and other identifying information. Users will have access to the platform to keep their client data after the KYC/Keely procedure is finished. Only the user has access to the encrypted and safely stored user data. Users of the platform may also keep an eye on any updates or changes to their client data by using the platform to monitor their data.

A Block

The Block is a website for news and analysis on cryptocurrencies. The website is committed to provide thorough and current information on the cryptocurrency markets as well as analysis and opinion on the industry’s advancements. Users of The Block may also follow and keep tabs on the regulation of cryptocurrencies, including the actions taken by the CFTC and other regulatory agencies.

Users of The Block may follow and keep track on the development of legislative amendments and enforcement actions. Users of the site may keep track of any new rules or recommendations made by the CFTC as well as any enforcement actions conducted against exchanges or other organizations. Users of The Block can keep tabs on adjustments made to the KYC/Keely program as well as any other advancements in the industry.

Conclusion

The Block, BitMEX 10M KYC/Keely, and the CFTC have all had a significant influence on how cryptocurrencies are regulated. In the process of creating regulations and guidelines for the cryptocurrency industry, the CFTC has adopted a proactive approach. In response to the CFTC’s need for more openness, BitMEX has developed a $10 million KYC/Keely initiative. Additionally, The Block has given consumers the option to follow and keep an eye on how cryptocurrencies are being regulated. These three significant people have together had a significant impact on the landscape of bitcoin legislation worldwide.